Is U.S. monetary policy behind the surge in commodity prices?"

Impressive run-ups in the price of oil and natural gas over the last 5 years have kept energy markets in the headlines. But it is difficult not to see this also as related in part to a broader movement in commodity prices generally. As these graphs from Kitco Base Metals reveal, the dollar price of copper, aluminum, zinc, and nickel have all basically doubled over the last three years.

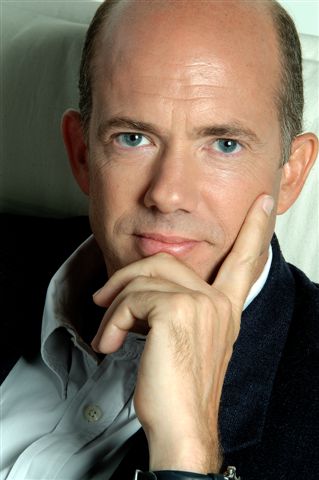

Jeffrey Frankel, Professor of Economics at Harvard University, argues that U.S. monetary policy may be part of the explanation. Low real interest rates, he notes, lower the cost of carrying physical inventories and increase the attractiveness of speculating in commodities relative to holding Treasury bills. He documents an impressive historical correlation as revealed by the scatter diagram at the left: those years in which the real interest rate was lowest tended also to be years in which commodity prices were high relative to other prices.

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου